By Saad Shabbir and Vaqar Ahmed[1] (SDPI)

1. Background

With a new a stable government in Afghanistan the prospects of peace, stability and regional integration reform have increased across Central Asia. The recent visits by the Afghan President to India and China indicate that Afghanistan is now looking to enhance its possibilities of regional cooperation. Pakistan’s military chief has also met Afghan President to discuss the bilateral politico-security issues. Pakistan being the next door neighbour of Afghanistan has remained one of its largest trading partner during the past decade. This cooperation is projected to deepen as both countries intend to expand the purview of Afghanistan-Pakistan transit arrangement.

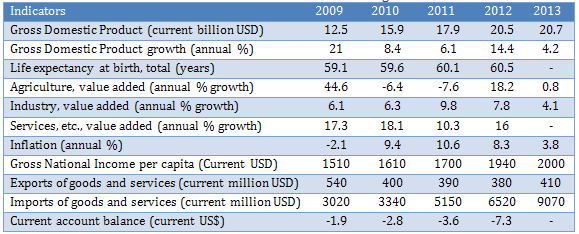

Afghanistan’s Gross Domestic Product (GDP) has shown a steady increase over the years from USD 12.5 billion in 2009 to more than USD 20 billion in 2013. Income per capita increased steadily from USD 1500 in 2009 to USD 2000 in 2013. The economic growth has exhibited some variations and the past 12 months have shown a slower GDP growth rate of 4.2 percent – lowest in the last 5 years. The agricultural output in 2013 remained almost the same as in the previous fiscal year. The industrial growth remained at 6 percent whereas the growth in services sector was recorded as 17 percent. Inflation dropped to 3.7 percent in 2013.

On the external side the exports of goods and services were recorded around USD 500 million whereas the imports of goods and services rose from USD 3 billion in 2009 to USD 9 billion in 2013. The current account balance remained negative and decreased over the years. These statistics however do not account for the substantial informal trade between Afghanistan and Iran, and Afghanistan and Pakistan.

Table 1: Macroeconomic Indicators of Afghanistan

Source: World Development Indicators

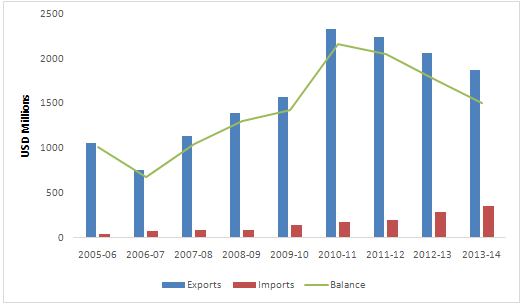

2. Trade Cooperation

Trade activity has been on the rise for most part of the last decade. Pakistan remains the largest trading partner of Afghanistan with a share of 28 percent followed by USA which has a share of 17.8 percent.[2] Afghanistan was the third largest destination for Pakistan exports in 2012-13.[3] Since 2006 both trading nations have managed to keep collective export and import value above USD 1.5 billion. While Pakistan’s growth rate of exports to Afghanistan has slightly decreased after 2011, however Afghanistan’s exports to Pakistan have steadily been on the rise (Figure 1).

Figure 1: Afghanistan Pakistan Trade 2006-14

Source: Pakistan Bureau of Statistics

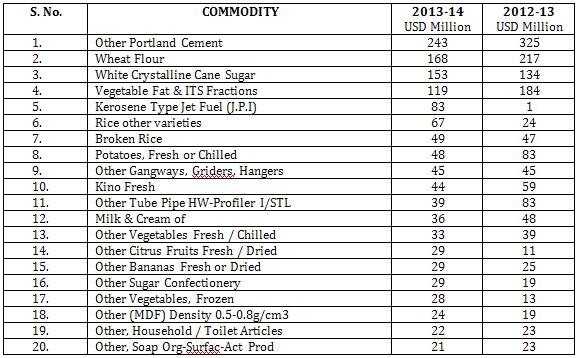

An analysis of the top 20 export items (Table 2) in 2014 reveals a dominance of cement, food and oil supplies. However we understand that items in the export basket are subject to substantial variation due to the fast changing demand in Afghanistan. For example a number of high-end food items were destined as supplies for the ISAF. The value of such items is subject to the number of ISAF personnel on-ground. Another example is Kerosene Type Jet Fuel, which had negligible export demand from Pakistan to Afghanistan in 2013 and this jumped to USD 83 million a year later.

Table 2: Top 20 Exports to Afghanistan from Pakistan

Source Pakistan Bureau of Statistics

Source Pakistan Bureau of Statistics

The major import items from Afghanistan to Pakistan include vegetable, fruits, raw cotton, carpets and rugs, hides, and skins. There is a growing industrial sector in Afghanistan which is projected to contribute to processed food manufacturing (particularly in case of fruits and vegetables). The growth in livestock sector is also providing an impetus to agriculture and the value added industry through its backward and forward linkages. With increased trade and transit linkages between Afghanistan, Pakistan and Central Asia, it is envisaged that the country’s agricultural exports will remain on the rise.

In the context of bilateral trade with Afghanistan the current issues that the Ministry of Commerce, Federal Board of Revenue and other relevant institutions in Pakistan are working towards, include:

- Customs cooperation agreement for data exchange

- Resolving issues related to re-exports

- Expanding trade facilitation available at the trade gates (Torkhum and Chaman)

- Integrated customs and border management facility.

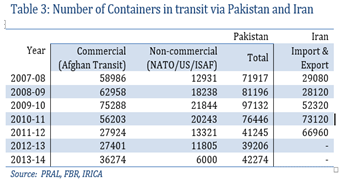

3. Transit Trade

The Afghanistan Pakistan Transit Trade Agreement signed in 2010 allowed two-way transit traffic to Afghans. This arrangement also implies that Afghan exporters can access the rest of the world through sea ports of Pakistan. Furthermore, Pakistan allowed the transit of perishable products through unsealed containers to India via Wahgah. The number of containers in transit via Pakistan and Iran are shown in Table 3.

There is substantial decrease in Afghan commercial as well as non-commercial transit via Pakistan. Compared to the year 2009-10 the commercial transit (as measured by the number of containers) has dropped to half from more than 75,000 to just above 35,000 in 2014. However, according to an anecdotal source, the dollar value of the transit trade has increased over the years. Given the uncertainty surrounding ISAF withdrawal from the region non-commercial transit has decreased to 6000 in 2013-14.

There is also evidence of transit traffic shifting from Pakistan to Iran. The major reasons for this being: improved infrastructure for both road and rail links, massive devaluation of Iranian currency against dollar thereby reducing transportation costs, extra charges at Pakistani ports for Afghan transit cargo and undue delays. Other issues include difficulty in obtaining visas for drivers under the Economic Cooperation Organization Transit Transport Framework Agreement (ECO-TTFA), delay in customs transit, and disruptions in Karakoram Highway due to landslides.

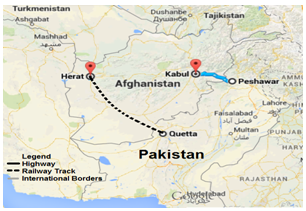

4. Road Connectivity

Pakistan extended support in reconstruction of Afghanistan in 2003 under the Technical Assistance Programme initiated by the Ministry of Planning, Development and Reforms, Government of Pakistan. Under this programme NESPAK started work on 24 infrastructure projects out of which 7 are still ongoing.

To sustain and promote bilateral trade between Afghanistan and Pakistan, the first phase of Torkham-Jalalabad road (75 km) was completed in 2006. With further help from the National Highway Authority the 222 km long Kabul-Torkham-Jalalabad road was completed in 2011. Phase II of the same project, Torkham-Jalalabad Additional Carriageway, started in January 2007. More than 50 percent of the project had been completed until November 2008 before it was suspended. The Government of Pakistan is now making efforts to remobilize the contractor and complete the project in December 2015.

Figure 2: Proposed Road and Rail Networks

Source: Google Maps

5. Railways Connectivity

If trade with Afghanistan is to be scaled upwards, the road networks that need to be urgently revamped include the Indus Highway (N-55), Regional Cooperation for Development Highway (N-25) connecting Karachi to Chaman via Lakpass, Lakpaas-Taftan (N-40), Sukkur-Quetta (N-65), and Nowshera – Dir – Chitral (N-45) Highway, Gawadar – Hoshab – Khuzdar – Rathodero Motorway (M-8) and Hasan Abdal – Mansehra Expressway.The National Highway Authority had also proposed a Peshawar-Kabul motorway under which the PC-II has already been prepared for carrying out the feasibility study and design. Pakistan will bear the costs towards feasibility study and design. Both the countries are also looking into an additional transit-trade corridor through a Bannu-Ghulam Khan- Khost Road/Rail link. In the road sector, Afghanistan has also offered the CAREC corridor from Pakistan to Tajikistan. Earlier this year, both Afghanistan and Pakistan had completed the feasibility study of the new link road between Jalalabad and Torkham. International financing agencies have offered a loan of USD 1.5 million for its construction.

If increased trade and transit traffic is to be facilitated across Afghanistan-Pakistan border, then a diversification of transport modes is required. One of the possibilities will be containerization via railways. Pakistan has recently approved the plan to operate trains twice a week under the Afghanistan Pakistan Transit Trade Agreement. One of the abandoned projects of rail link between Chaman and Spin Boldak, which was approved in 2004 is now being reconsidered. After re-evaluating the cost of the project, the proposal is under consideration by relevant authorities for approval. This rail link was the first phase of the three phase project that will join Pakistan to central Asia via Spin Boldak – Kandahar – Herat to Turkmenistan. The funding agency is yet to be finalized.

On the request of Afghanistan, Pakistan is considering to extend technical support and training for capacity building of the staff of the newly established Afghanistan Railway Authority (AFRA). In addition to the new rail link projects, Peshawar-Landikotal-Torkham rail link, Quetta-Taftan rail link will need to be rehabilitated. While the Gwadar-Khuzdar-Rathodero Rail link may be constructed under Pak-China Economic Corridor project.

Pakistan hopes to facilitate Afghanistan trade via road and rail network to cater the new volumes of bilateral and transit trade. For the efficient and smooth flow of trade, border crossing points require modern facilitation. Pakistan aims to build state of the art border stations at Torkham, Chaman, Wahgah, and Taftan borders. Electronic Data Interchange to provide online real time information of bilateral and transit trade will be made functional. WeBOC (Web Based One Customs) is also being made operational and the issue of registration of Afghan importers is being expedited to resolve issues of partial shipment and undue shipment delays at border crossing points. The issue of multiple tracking devices on Afghan transit freights and the requirement of jawaznama by Pakistan is being revisited.

6. Energy Cooperation

One of the key challenges that hampers the economic growth of Afghanistan and Pakistan today is a shortage of energy. The issue of long hours of power cuts has paralyzed the manufacturing sector in both countries. If unresolved it will not allow the two neighbouring countries to come out of this economic lull. With support from the World Bank, Afghanistan and Pakistan have signed an agreement in October 2014 on the tariff rates of electricity transmission under the Central Asian and South Asian (CASA-1000) Transmission and Trade Project.

Figure 3: IPI and TAPI pipelines

Source: Heritage.org

The project inception of Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline to supply gas from Turkmenistan to the rest of the countries dates back to 1995. The negotiations under this project remained slow. However, with the ongoing energy deficit in Afghanistan, India and Pakistan the prospects of this project are gradually taking shape. The second phase of negotiations started in 2008 is still underway as some key issues have to be resolved that include transit fees, contact points, and transfer infrastructure for the supply of gas.The project will supply the surplus summer energy from the Kyrgyz Republic and Tajikistan to Afghanistan and Pakistan connecting the central and south Asian states, and contributing to regional stability and inter-dependence. Under the agreed terms, Afghanistan will get 300 MW while Pakistan will get 1000 MW energy with a transmission price to Afghanistan of 1.25 cents per kW and 5 cents per unit to Pakistan. The project that started earlier this year will be completed in 2020 with a total estimated cost of 1 billion USD. Another initiative under consideration by Asian Development Bank and World Bank is the Turkmenistan, Uzbekistan, Tajikistan, Afghanistan and Pakistan (TUTAP) energy project.

[1] Saad Shabbir is a Senior Researcher at Sustainable Development Policy Institute and aspires to work towards an integrated South and Central Asian region.

Dr. Vaqar Ahmed is Deputy Executive Director at Sustainable Development Policy Institute. He also heads the Economic Growth Unit responsible for macroeconomic analysis, international trade and public finance

References

[2] Eurostat, European Commission (2013)

[3] State Bank of Pakistan Annual Report (2012)