By Saad Shabbir and Vaqar Ahmed[1]

Sustainable Development Policy Institute (SDPI) Pakistan.

1. Background

Pakistan and Iran have been allies through the long and arduous cold war years. During the 1980s both countries supported the Afghan push-back against the Soviet Union. Both countries supported the Bonn agreement to plan for a stable and prosperous Afghanistan. Similarly both signed the Kabul declaration on Good Neighborly Relations in 2002. However the warmth in this relationship has often been tested due to the continuing civil war in Afghanistan, sanctions on Iran, negotiations around nuclear technology in Iran, and Pakistan’s close friendship with Saudi Arabia.[i]

With current successes in the nuclear technology negotiations, Iran’s economy is being projected to strongly bounce back as sanctions are lifted. The country is the second largest market for fast moving consumer goods in the Middle East (after Egypt). It has a relatively younger population compared with several other economies in the region and vast reserves of oil and gas still remain to be exploited.

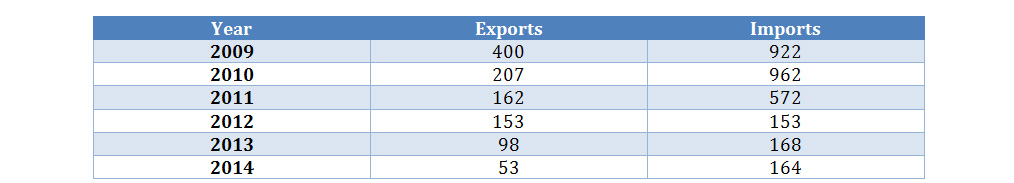

Iran’s Gross Domestic Product (GDP) exhibited a steady increase from USD 362 billion in 2009 to USD 502 billion in 2012 after which there was a sharp decline to USD 369 billion in 2013 partially attributed to the effect of international sanctions. In 2013 the economic growth rate measured by the real GDP growth was negative 5.8 percent which was the largest decline since 2009. The inflation rate and weakening currency has been a major concern for the Iranian economy. In 2009 the inflation growth was 2.5 percent which jumped to 14.4 percent in 2010 and then 25.7 percent in 2011, the highest in the last five years. The inflation rate has remained in double digits until 2014.

Table 1: Macroeconomic Indicators of Iran

Source: World Development Indicators

In April 2015, during the 7th Iran-Pakistan Joint Trade Committee meeting, Iran and Pakistan concluded a 5 Years trade facilitation plan with an expected gain of USD 5 billion. This trade deal could see relaxation in the protectionist trade regime in Iran. Currently the country practices import bans, high customs duty on textile (an item of key interest to Pakistani exporters) and a complicated authorization regime for importers in Iran.

This paper provides a situation analysis on Iran Pakistan trade (in section 2), followed by the current status of agreements and their implementation in the Economic Cooperation Organization (ECO). In section 4 we explain key interventions in the trade policies of both countries which could yield mutual gains in merchandise trade. We conclude with brief policy recommendations.

2. Iran – Pakistan Trade

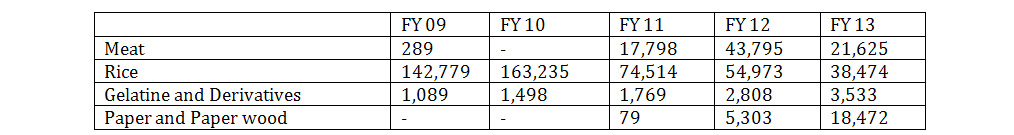

Despite a large potential discussed in several studies, the bilateral trade between the two countries has remained low (Table 2). Iran is a country rich in natural resources with the world’s second largest gas reserves. Pakistan is an energy deficient country that has not been able to meet its natural gas demands. Lack of cooperation between the two countries was mainly due to the embargoes on Iran from the global community.

Table 2: Pakistan’s Trade with Iran (Million USD)

Source: Pakistan Bureau of Statistics

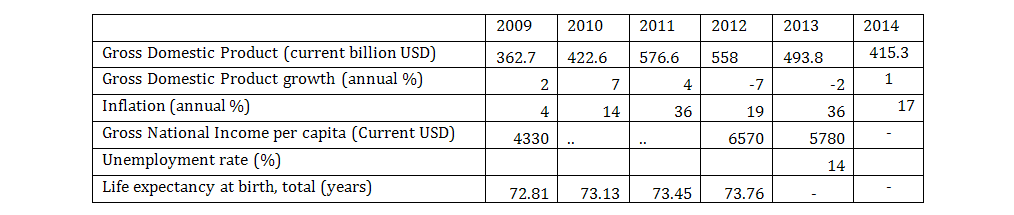

Trade between Pakistan and Iran currently comprises of mainly oil and gas from Iran (Table 3), and rice and meat from Pakistan (Table 4). Pakistan has expressed the desire to enhance export of meat, fruits, textile, surgical items, sports goods, gems and jewelry in addition to rice. In 2014 overall trade with Iran was USD 217 million out of which USD 53 million were exports from Pakistan. The key export items of Iran to Pakistan include: iron ore, iron scrap, dates, detergents, transformers, chemicals, bitumen, polyethylene, propylene, etc. while export items of Pakistan to Iran include rice, fresh fruits, meat cloth and mechanical machinery.

Table 3: Pakistan Imports from Iran (Thousand USD)

State Bank of Pakistan

Table 4: Pakistan Exports to Iran (Thousand USD)State Bank of Pakistan

Key reasons for low trade volumes include high non-tariff barriers in Iran, high customs duty on items in which Pakistan has comparative advantage (e.g. textile), slow process of import approvals in Iran, lack of enabling infrastructure that can facilitate trade on Pakistan’s side, poor rail, road and air connectivity between the two countries, and less number of land border trade posts.

3. Iran, Pakistan and ECO: Economic Cooperation Agreements

Iran and Pakistan have signed 5 Memorandum of Understanding (MoU) in December 2014 to enhance trade cooperation. Under these agreements, a Joint Investment Committee would be formed to identify areas for investment in both countries. Furthermore, both countries agreed to open up bank branches and facilitate a currency swap for bilateral trade. It was agreed that cooperation between Pakistan’s Small and Medium Enterprise Development Authority (SMEDA) and Iran’s counterpart organization would be enhanced. An agreement was reached to establish a sister port relationship between Karachi and Chahbahar ports. Trading centers along the Iran-Pakistan border were also identified that could be used as common markets to sell goods at concessional rates of customs and other duties in order to control illegal cross border trade.

Iran Pakistan Gas Pipeline

The Iran-Pakistan Gas Pipeline project was conceived in the 1990s however the agreement was not signed until 2009. According to the agreement, Iran will supply 750 million cubic feet of natural gas each day to Pakistan. The distance of the pipeline from the Pars gas field to Pakistan-Iran border is 1,150 km and 781 km on the Pakistan side where it joins the domestic pipeline network. The construction of the pipeline was scheduled to be completed by December 31, 2014. Iran has nearly completed its portion of the pipeline whereas Pakistan could not start the construction due to lack of funds. Pakistan was unable to gather loans from banks owing to sanctions on Iran. Currently, Pakistan is in negotiations with Chinese companies that will construct the pipeline from Gwadar to Nawabshah on 85 percent loan and complete it by the end-2015. The 70 km portion of the pipeline from Gwadar to Iran border will be constructed by Pakistan.

The gas pipeline which started off as a project to supply natural gas from Iran to Pakistan, initially also had India as a partner. It was envisaged that the pipeline would go across Pakistan and into India. The latter however withdrew from the project because of high rates and security reasons.[ii] India has now pitched an offer to Iran to import gas from its Western gas field via deep sea. India is also looking towards a deep-sea gas pipeline project with Oman.

Iran Pakistan Preferential Trade Agreement (PTA)

This PTA was signed on 4 March 2004 and ratified in May 2005. The objectives of this agreement were to enhance the economic and political relationship between the two countries. The two nations were to treat each other as the most favored nation and boost the trade flow by eliminating all non-tariff barriers on movement of goods. Furthermore, no changes in existing tariffs were to be made without the consent of both the parties.

It will be appropriate at this stage to review this PTA. Trade with Iran as a percentage of Pakistan’s total trade was 1.54% one year before the PTA came into force.[iii] However by 2012 this had declined to 0.38%. The imports as percentage of exports to Iran were 367 percent, which declined to 85% during the same time period.

The trade embargo on Iran was another reason why PTA could not achieve its full potential. Pakistan lost exports to Iran in important agriculture sub-sectors. Over 30,000 tons of mangoes and 60,000 tons of citrus were exported to Iran.[iv] While the market for mangoes has completely been lost, exports of citrus (kinnow) have fallen below 6000 tons. In 2010 Pakistan exported USD 163 million worth of rice to Iran, which fell to USD 38 million in 2013. A substantial amount of rice is now being routed through Dubai due to banking restrictions on Iran. Both countries had also signed an agreement where Iran will provide oil in lieu of 0.2 million tons of rice from Pakistan. However this agreement has yet to be implemented.

Economic Cooperation Organization Trade Agreement (ECOTA)

ECOTA was signed in 2003 by 5 out of 10 ECO member countries namely, Pakistan, Iran, Turkey, Afghanistan and Tajikistan. Under the ECOTA Vision 2015 inked in 2005, this agreement will pave way for a free trade area. ECOTA has not been implemented yet, due to the different interpretations of agreement articles related to the reduced tariff by Iran, Pakistan, and Turkey.[v] According to the tariff reduction modality for the implementation of ECOTA, the member states are required to reduce tariffs on at least 80% of the tariff lines to a maximum tariff of 15% over 8 years with the exception of Afghanistan for which the implementation period is 15 years.

ECO Trade and Development Bank

The Bank is the financial arm of the Organization and has commenced operations with a Representative Office in Karachi. It has a subscribed capital of 300 million SDR (Special Drawing Rights). Pakistan, Iran and Turkey have equal contribution. The major objectives of the ECO Trade and Development Bank include mobilizing and utilizing the financial, natural and human resources of the member States with a view to capitalizing on the region’s economic potential. The headquarters of the Bank are in Turkey.

Transit Transport Framework Agreement (TTFA)

TTFA was signed by all the member states except Uzbekistan, and ratified by 8 Member States (all except Turkmenistan and Uzbekistan). This came into force in 2006. The agreement addressed all issues relating to transport and transit trade in a comprehensive manner. The studies for the 12,298 km rail and 11,450 km road network have been completed.

The ECO Fund for implementation of the TTFA has already been established. The joint ECO Secretariat and Islamic Development Bank (IDB) regional project for the implementation of TTFA is in its final stages of implementation.[vi]

ECO Silk Road Truck Caravan from Islamabad to Istanbul

An ECO Truck Caravan comprising all ECO member States except Kyrgyzstan and Uzbekistan was launched from Quetta (with the inaugural ceremony held in Islamabad in 2010). This initiative was launched under the TTFA. The member states allocated capital from the Feasibility and General Purpose Fund (FGPF) for the Caravan.

ECO Reinsurance Company

In accordance with Article VI of the Treaty of Izmir (1977) and MoU on ECO Reinsurance Company (1995), Pakistan, Iran and Turkey decided to establish a regional ECO Reinsurance Company. The Company is a tripartite venture between Pakistan, Iran and Turkey however, only Pakistan has so far ratified its Articles of Agreements. The main purpose of the Company is to supplement existing reinsurance services in the region and promote the growth of national and regional underwriting and retention capacities, minimize the outflow of foreign exchange from the region and to support economic development in the region.

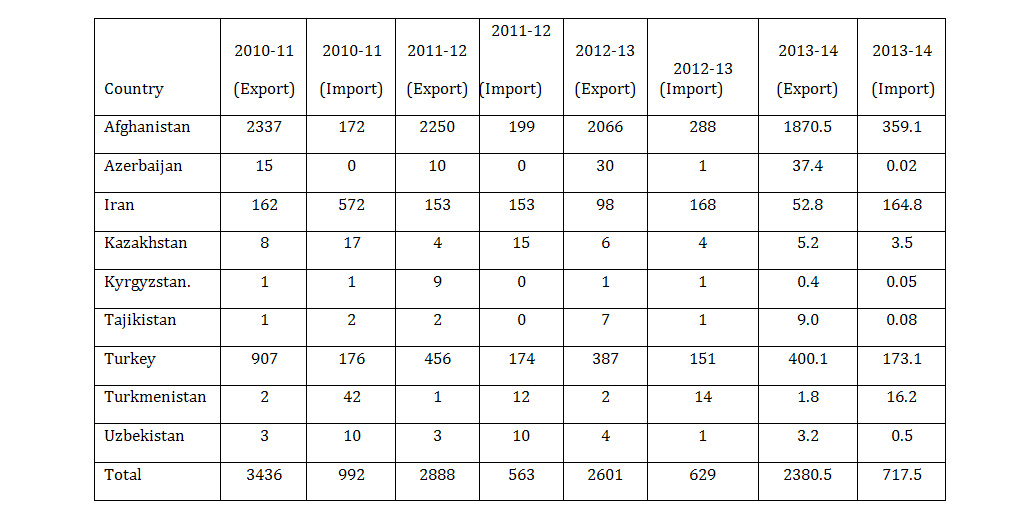

Pakistan has not been very successful in increasing its trade with ECO member countries. Table 5 shows Pakistan’s low trade levels with ECO countries for the last 4 years. The low trade in the region can be attributed to Pakistan’s weak priority and political will attached with regional trade.[vii] These low levels however do not capture the growing informal trade in the region.[viii] Unlike the Association of South East Asian Nations (ASEAN), ECO region has also been unable to build regional economic corridors that can help in creating longer term supply chain linkages.[ix]

Table 5: Pakistan’s Trade with ECO Countries (Million US$)

Source: PBS

Iran Pakistan Energy Cooperation

Historically, Pakistan has agreements to import 74 MW electricity from Iran since 2002. Because of political pressure and inability to carry out banking transactions it was decided that Pakistan would export goods like wheat and rice against electricity due of USD 100 million. The transmission of electricity is currently being carried out through a 170 km transmission line from Iran to Pakistan.[x] In 2012, Pakistan signed a MoU to import 1000 MW of electricity from Iran at PKR 10 kWh. According to the National Electricity and Power Regulatory Authority’s (NEPRA) fuel adjustment charges notification of December 2014 Pakistan imported 31.3GWh of electricity from Iran in December 2014.[xi]

In 2015 Iran offered to export another 3,000 MW of electricity to Pakistan. Given the recent dip in the world oil prices, Iran faces competition from the cheaper oil imports. The price differential of electricity generation is now only PKR 2 per kWh; Iran offers electricity at PKR 10 per kWh whereas electricity generated from imported oil costs PKR 12 per kWh.[xii] Thus importing power from Iran is gradually becoming less lucrative.

Pakistan has submitted an alternative plan according to which a liquefied natural gas (LNG) pipeline will be laid from Gwadar to Nawabshah and connected with Iran after the sanctions are lifted. Pakistan has also signed a deal with Qatar to import LNG.

Road and Rail Network

Taftan- Dalbadin- Noshki-Quetta (N-40) is an approved highway link in Pakistan – a 370 km long highway connecting Quetta to Taftan at the Iranian border. The project is being pursued under public-private partnership where NHA has involved the private sector to cover a budget short fall.

The Istanbul – Islamabad – Tehran railway network was first proposed in the 18th Regional Planning Council of the ECO held in Islamabad in 2008. This was envisioned under the ECO framework where the ultimate goal was to connect Central Asia with Europe. This 6,500 km long rail network is one of the major projects of ECO. Around 1,900 km of the overall portion passes through Pakistan, 2,570 km through Iran, and the remaining through Turkey.

The decision for revival of Gul Train (freight train Islamabad-Istanbul via Tehran) is still pending. Pakistan Railways has resumed freight operations between Iran (Zahidan) and Pakistan (Quetta). Currently 24 bogies are being operated with plans to expand this to 40 bogies. The response from Turkey to operate the train until Istanbul is still awaited.

4. Way Forward

A key reason for low trade between the two countries is high non-tariff barriers (NTBs) in Iran. Under the 2006 PTA between both countries, early elimination of NTBs was promised by both countries. However in the case of Iran, import bans and costly authorizations for imports are still in place. Both neighbors will also need to make joint and synchronized investments in infrastructure as a key trade facilitation measure. The air, rail, road and sea links between the countries need a careful review from the business community’s perspective. There is also a need to open more trading routes between the two countries. The border trade posts that can immediately be made operational include Gabd-Reemdan and Mand-Pashin.

Opening of new trade routes can be complimented by establishing border haats which is a traditional way of marketing local output through local markets established on the border. This positively impacts the welfare of communities living on both sides of the border.[xiii] Bangladesh and India have already initiated such an arrangement on their borders in 2010. The commodities being traded in these haats include locally produced food items, garments, beverages and other production by the local cottage industry. Similarly, an Iran-specific economic zone in Pakistan should also be introduced.[xiv] To Pakistan’s advantage rice and fruit processing plants can be established in this zone bordering Balochistan. Similarly Iran may invest in mineral and oil exploration in the Balochistan province of Pakistan.

There is a clear dearth of research when it comes to assessing a realistic trade and investment potential between the two countries. It is proposed that future research should focus on: a) estimating trade potential in both merchandise and services, b) estimating the cross-border investment potential of Iranian and Pakistani business community, c) potential for building cross-border value chains and d) estimating the size of informal trade between the two economies. The size and extent of sector specific smuggling for example in petroleum products also needs to be assessed.

A perception survey is required where the business community in Pakistan may be directly asked about: a) key sectors in which exports to Iran can be enhanced, b) barriers in trading with Iran, and c) trade facilitation required to enhance trade volume. A desk review may also explore the sector-specific exports to Iran during the pre-sanctions time.

The policy research think tanks working on Iran-Pakistan trade cooperation should be strengthened by the governments and development partners. Think tanks should independently host annual Iran-Pakistan Economic Summits that can not only bring together the government and business community in a track-II setting, but also help in strengthening a community which can undertake longer term work on bilateral cooperation.

The business community will also have to play a sustained role in strengthening the track-II process. The Iran Pakistan Joint Business Council is currently dormant. Private sector led exhibitions on both sides have not taken place since long. Visits under trade delegations have declined. The ongoing discussion regarding establishing of a business forum of shipping companies of Iran and Pakistan has yet to materialize.

PTA between the two countries may also be provided further depth by including preferential treatment for trade in services and cross-border investment linkages. This will promote supply chains between the two countries and in turn create longer term strategic interdependencies. At a policy level this will require an agreement between both countries to remove any double taxation, increase banking channels and allow both government-to-government and business-to-business joint ventures. The latter will also need amendment in foreign currency rules (by the State Bank of Pakistan) and provision of ‘automatic-route’ investments by the Board of Investment in Pakistan. This will ease the repatriation of capital and profits on both sides, in turn, facilitating quick entry and exit of businesses. Currently there is no recent study that estimates the potential of trade in services or direct investment between the two economies.

Pakistan may also review its statutory regulatory orders (SROs) to bring in greater harmony between trade preferences allowed to the South Asian Association for Regional Cooperation (SAARC) and ECO countries. Currently several items have already been allowed preferential tariffs under South Asia Free Trade Area (SAFTA), however the same items have not been allowed lower rates if these originate from Iran (or ECO region).

Pakistan also needs to leverage investments under China-Pakistan Economic Corridor for boosting trade with Iran. For e

[1] Saad Shabbir is a Senior Researcher at Sustainable Development Policy Institute and aspires to work towards an integrated South and Central Asian region.

Dr. Vaqar Ahmed is Deputy Executive Director at Sustainable Development Policy Institute. He also heads the Economic Growth Unit responsible for macroeconomic analysis, international trade and public finance.

[i] Harsh Pant, “Pakistan and Iran’s Dysfunctional Relationship,” Middle East Quarterly, Spring 2009, pp. 43-50; Shah Alam, “Iran‐Pakistan relations: Political and strategic dimensions,” Strategic Analysis, Volume 28, Issue 4, 2004.

[ii] Zahir Shah, et al., “Pak-Iran Relations: New Dynamics and Prospects,” Journal of Applied Environmental and Biological Sciences, 2015, p. 66.72.

[iii] Rashid Kaukab, “The Changing Landscape of RTAs and PTAs: Analysis and Implications,” The Lahore Journal of Economics, 2014, pp. 411-438.

[iv] Majyd Aziz, “Pakistan and Iran: New Goalposts,” Presentation: Pakistan’s Relations with Regional Countries (Afghanistan, Iran and CARs), National Institute of Management, Karachi, December 16, 2013.

[v] Business Recorder, May 26, 2013.

[vi] Zukhra Abisheva, “Report on Implementation of TTFA,” National Trade and Transport Facilitation Committee: Workshop on TIR Convention, (2014).

[vii] Samavia Batool and Vaqar Ahmed, “Trading with India: Lessons Pakistan must learn from Bangladesh and Sri Lanka,” Criterion Quarterly, Volume 9, 2014.

[viii] Vaqar Ahmed, et al., “Informal Flow of Merchandise from India: The Case of Pakistan,” Book: India-Pakistan Trade – Strengthening Economic Relations, Springer India 2015.

[ix] Ghulam Samad and Vaqar Ahmed, “Trade Facilitation through Economic Corridors in South Asia. Book: Developing Economic Corridors in South Asia, Asian Development Bank (2014).

[x] Arshad Abbasi, et al., “Rethinking Pakistan’s Energy Equation: Iran-Pakistan Gas Pipeline,” Sustainable Development Policy Institute – Policy Brief, 2013. DOI: http://sdpi.org/publications/files/IP-Report.pdf

[xi] NEPRA. Price Adjustment: December 2014.

[xii] The Express Tribune, Feb. 18, 2015.

[xiii] For example on welfare implications of trading with Afghanistan, see: Saad Shabbir and Vaqar Ahmed,” Welfare Impacts of Afghan Trade on the Pakistani Provinces of Balochistan and Khyber Pakhtunkhwa,” Stability: International Journal of Security & Development, 4(1): 6, pp. 1-16, 2014.

[xiv] Majyd Aziz, “Pakistan and Iran: New Goalposts,” Presentation: Pakistan’s Relations with Regional Countries (Afghanistan, Iran and CARs), National Institute of Management, Karachi, December 16, 2013.